Buying a home is likely to be the most expensive purchase you make. A Vospers home survey will provide you with vital knowledge about the true condition of the property you have chosen. This information can help you in negotiations and enable you to make an informed decision about whether to proceed with your purchase.

Vospers provide surveys prepared in line with the RICS Home Survey Standards (HSS 2021). We offer two main levels of survey:

RICS Home Survey level 2 (previously known as the RICS Homebuyer Report)

This type of report is ideal for a flat, bungalow or house of conventional type, built to common building standards and generally appearing to be in reasonable condition.

Vospers Building Survey (RICS HSS Level 3)

Our building surveys give a more detailed consideration of each property. Being prepared in line with the RICS Home Survey Standard (HSS) Level 3 these reports are individual and bespoke to each property.

Our reports are produced in line with the Royal Institution of Chartered Surveyors (RICS) Home Survey Standard. RICS is the UK’s most respected authority on surveying and valuation.

Your mortgage lender’s valuation report is not a survey – it simply informs the lender whether the property is reasonable security for your loan. A Vospers survey will tell you more, to help you make an informde decision.

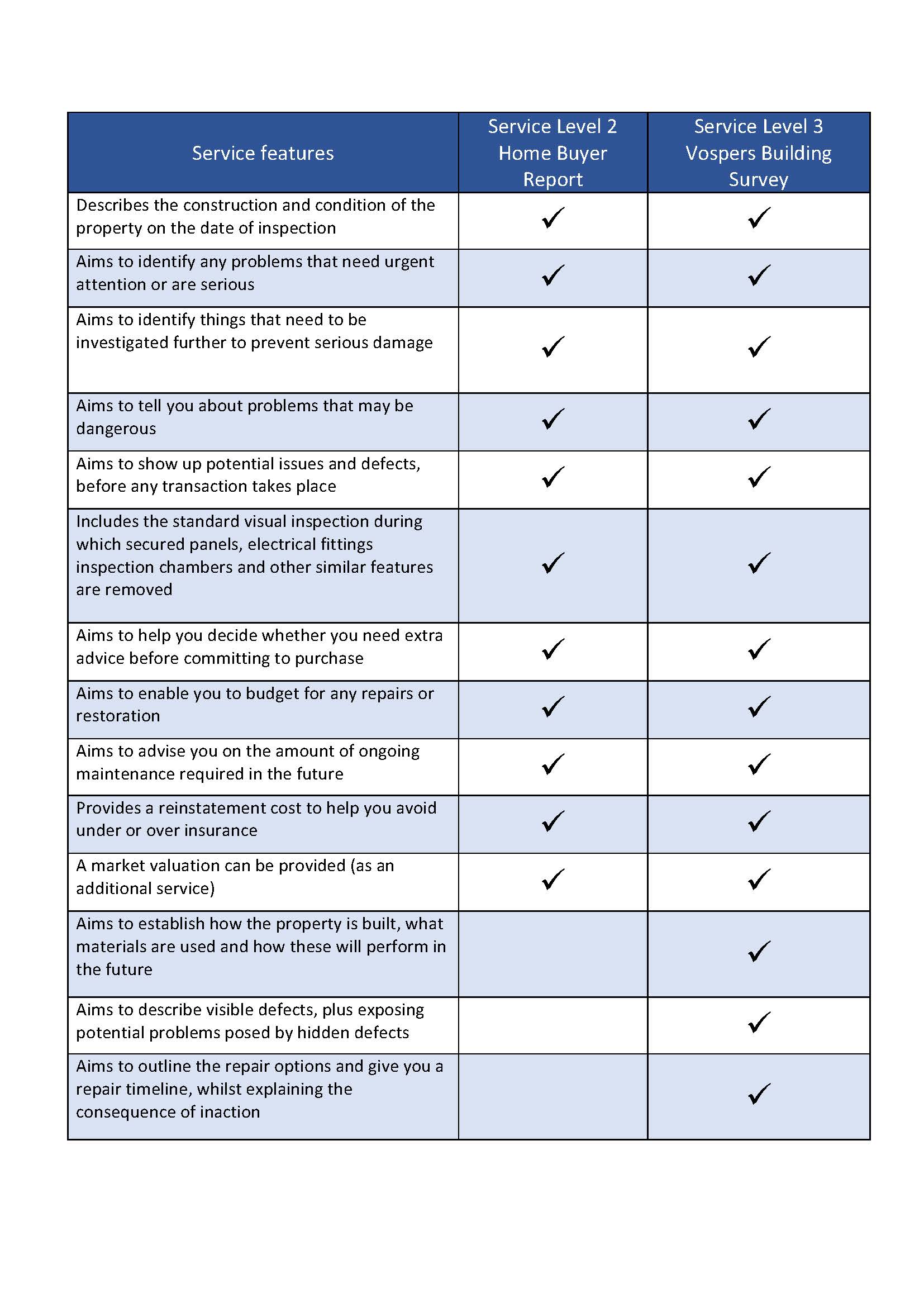

This table will help guide you to the most appropriate survey, but if you have any particular requirements, call us.

We can provide a range of extra property services on request.

Book your survey or request a quote

We are happy to carry out surveys in Surrey, Hampshire, Berkshire and West Sussex.

Contact us to book your survey or to request a quote for your home survey.

Further information

If you have a question or need more information, please do contact us.

If you ever find yourself as the Executor of a Will, you may be slightly confused about what to do next. As Executor you will be responsible for valuing the assets of th...

4 Castle Street,

Farnham,

GU9 7HR

400 Thames Valley

Park Drive,

Thames Valley Park,

Reading,

RG6 1PT

Afon House,

Worthing Road,

Horsham,

RH12 1TL

Copyright © 2021 VOSPERS Chartered Surveyors & Valuers.

All rights Reserved.

Designed and Developed by JDR Group